Content

For this method, you will need to understand what your average profits from previous years are. Add together the profits of previous years, and divide by the total number of years.For example, you may have earned $200,000 in 2010, $220,000 in 2011, $190,000 in 2012, and $210,000 in 2013. Start by determining the average profits for the years under https://www.bookstime.com/ consideration. To find average profits, you add together the profits of all the years and divide by 4 . With all of the above figures calculated, the last step is to take the Excess Purchase Price and deduct the Fair Value Adjustments. The resulting figure is the Goodwill that will go on the acquirer’s balance sheet when the deal closes.

Despite this, the brand reputation adds value to the company, and thus enhances the company’s sale price. Despite being an intangible asset, calculating and recording goodwill is an important part of the business valuation. The excess of the amount of capital over the total capital employed by the business can be considered goodwill. This means company X paid $800,000 premium above the company’s net identifiable assets to acquire its unidentifiable assets, which add to its earning power.

How to Calculate Goodwill of a Business: Step-By-Step

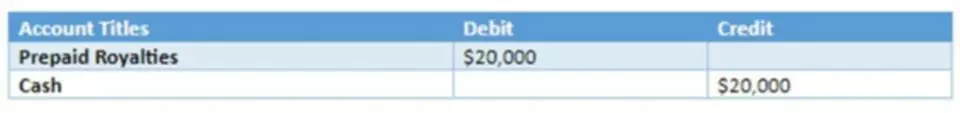

As the acquired goodwill lasts for several years, it will be considered a long-term asset. Under generally accepted accounting principles , goodwill impairment is done, and its value is reviewed once a year. To calculate goodwill, subtract the fair value adjustments from the excess purchase price. Following the acquisition, this will be recorded in the acquirer’s balance sheet. The excess purchase price is the difference between the actual purchase price paid to acquire the target company and the net book value of the assets .

Goodwill refers to an intangible asset that has to do with purchasing one company by another. In essence, it accounts for the excess purchase price of another company. This means that if a company’s purchase price is less than the target’s book value, the goodwill gained is negative. In other words, this company purchased the target company at a bargain is a distress sale. When a company sells at an unexpected premium, the excess purchase price is often due to an intangible asset known as business goodwill. In short, goodwill can be seen as the difference between the purchase price and the fair market value of a company’s identifiable assets and liabilities. Goodwill impairment is an accounting charge which occurs when the value of goodwill is determined to be below the amount previously recorded at the time of the original purchase.

How Does Company Goodwill Work?

It is also estimated that the fair value of identifiable assets and liabilities to be acquired is $200 million and $90 million, respectively. Goodwill is equal to Seller Proceeds less the what is goodwill net identifiable assets of the target company. Net identifiable assets is equal to identifiable assets less liabilities, which per the accounting equation is equal to shareholders’ equity.

Instead, it’s the business’s responsibility to monitor the value of goodwill and apply impairment when necessary. – Definition of this accounting concept, and detailed explanation of the equation… We are calculating the goodwill created through company P’s acquisition of company Q in 20X5. Chyou is a published author who focuses on the field of international business. After an established career facilitating mergers and acquisitions for medium to large corporations, Chyou turned to writing to help students better understand international business concepts.

Company

We therefore shall turn our attention to the second type of goodwill in this article, as our goal is to calculate then recognize it in financial statements. When customers are facing struggles in choosing between companies offering products and services, goodwill will help in setting a company apart in its own favor.

Let us assume that the DaimlerChrysler group company paid €10,000 for all the shares in AMC. In the balance sheet of the acquiring company this transaction will be recorded as an asset ‘Investment in AMC €10,000’. Since the amount was paid directly to the shareholders of AMC, the AMC balance sheet is unaffected. Let us suppose that the net asset value of AMC at the time of acquisition was €7,439, this would leave €2,561 unanalysed.

Illustrates the balance-sheet impacts of purchase accounting on the acquirer’s balance sheet and the effects of impairment subsequent to closing. Assume that Acquirer Inc. purchases Target Inc. on December 31, for $500 million. As of December 31, 2010, it is determined that the fair value of Target Inc. has fallen below its carrying value due largely to the loss of a number of key customers. Arises where the amount paid by the group for a new subsidiary to the group is in excess of the net asset value (i.e. the net equity) of that subsidiary.